Equitybase: Elements of an ecosystem of real estate investment

INTRO

Equitybase is applying blockchain and smart contract technologies to the world of Real Estate investments and holdings in order to solve these issues. BASE is an Ethereum Smart-Contract ecosystem that focuses on creating a viable platform for Real Estate investment.

Equitybase will offer an effective and direct model of investing and securing the value of the existing 500+ Billion USD equivalent in cryptocurrency, to the less volatile and growing real estate market, by generating rental income, value appreciation and hedging.

Participants worldwide will be able to utilize our platform to invest and diversify their portfolio, along with the liquidity of a public market but generate the returns of a private market.

Backed by our experts with a strong track record and reputation in real estate development, consumer electronics and tech industry, we at Equitybase have raised a $300,000 seed round. We have founded and exited high profile online companies along with extensive experience in the real estate industry and operating startups for over the last 15 years.

By fall of 2018, IOS and Android apps will be available to our platform users as well, with the full functionality of our website securely on their mobile devices.

Better Returns, Lower Risk

See the risk and returns across major asset classes in the last two decades

Equitybase platform will be utilizing a Hybrid Market system which enables high annual return of a private market system along with the liquidity of a public market.

Our platform is based on 2 values of unit

BASE token, which can be kept in any Ethereum based smart/cold wallet, is an ERC20 based blockchain token with vesting functions. BASE token are created on token sale backed by a smart contract and will be on a fixed volume basis, which are stored in any Ethereum ERC20 base wallet. Equitybase platform does not restrain investors on minimum investment or holding period.

BASE Token growth strategy

To provide an escalated growth to the platform, the company will introduce the reserved BASE tokens 6 months after the lock period is passed, we will implement a well-executed strategy in order to maintain a stable token price.

Equitybase's Hybrid Market platform will offer simple, transparent and direct property investments. That removes the uncertainties usually encountered by individual investors and enabling virtually anybody to build a real estate investment portfolio that delivers predictable and consistent returns without a lock-in period. Project sponsors and developer around the world would also be able to utilize our platform with identical functionality.

Equity Invest

Equity Invest will be based on Etherum smart contract that represents the property acquisition (We call this REAL Estate Offering or REO). All calculation of returns is based on suggested hold period on each specific deal.

- REO ID and type of offering

- Funding Amount

- Suggest Hold Period

- Target annual cash rate, target IRR, target equity multiple

Real Estate Offering or REO will represent the shares on each property. Each investor will be able to exchange or liquidate their holdings for the property’s participations through our equity exchange platform. REO will also be tradable inside equity exchange platform. So, any investor will be able to transfer and sell their investment to gain liquidity. The REO holders will automatically receive the principal investment plus the ETHER corresponding to the profits of the sale of the property.

Equity Reserve

Equity Reserve will enact as a secondary reserve operator which provides an additional layer of liquidity to the Equity Exchange platform, it will be utilize as a reserve pool to continuous enable platform users to liquidate their holdings with guarantee buyback on the exchange.

Equity Exchange enables fractional trading of real estate asset or real estate fund similar to stock market without a lock-in period.

Equitybase APP

Equitybase app connect users to the blockchain by utilizing smart contracts, users will be able to access their assets and investment information, which values are recorded in the ledger of the blockchain.

Investment Stack

The capital investment types outline the relationship between the equity and the debt. The lower down on the stack the lower the risk to that capital, and vice versa as you move higher up.

The capital stack represents all the different types of capital invested into a real estate asset and the relationship between each category.

Capital investment

Equity: Represents an ownership interest in the asset.

Debt: Loan given to the equity ownership and typically collateralized by the asset itself or other assets of the equity owner.

Common Equity

Equity investors, unlike debt, participate in the success of the investment, meaning that their upside or potential returns are not capped but can increase or decrease depending upon the performance of the investment.

Preferred Equity

As a hybrid structure, this type of investment is senior to traditional equity investment but subordinate to the debt. Often the return structure is also a hybrid between true equity and debt, where mezzanine/preferred equity investors receive a fixed annual payback over a specific investment term but potentially can participate in the upside or continued success of the investment.

Debt

Debt is always lower down on the capital stack and therefore senior to the equity, meaning that it is first to be paid back. Most real estate debt is provided by traditional lenders, such as banks, that take the senior secured position.

Equity Fund

Equity Fund mission will be acquisition, development and management of commercial real estate assets through: careful selection, curation, value investing and impeccable portfolio management. Equitybase will mainly focus on midsize assets between $5-100 Million USD.

We utilize a value-added investment strategy; value-added investing has tended to producing higher returns over the long term to property value along with passive income.By carefully selecting the real estate portfolio, Equity funds intend for long-term value and revenue generation. Equity Fund seeks to attain competitive purchase prices, and offers tailor-made leases and repositioning of asset.

Focus:

- The implementation of a diversified portfolio of top quality commercial properties which create high return rate for residual income and capital gains.

- Identifying of value-added investment opportunities and projects to generate fixed income on the interim while higher rate of return once renovation completed.

- An investment analysis aimed at generating higher value through focusing on quality assets in prime locations with the potential to generate steady and sustainable cash flows.

- Redevelop urbanize property into a viable mixed-use or commercial project to generate substantial returns for its participants.

TYPE: Value Add

Office building with exterior and interior updates

Square Feet: 83,252sq²/7,734m²

Net Profit After Capital Events

TYPE: Development

Mixed-use development 120 Residential Units with 20,000sq² Retail

Square Feet: 130,000sq²/12,077m²

Net Profit After Capital Events

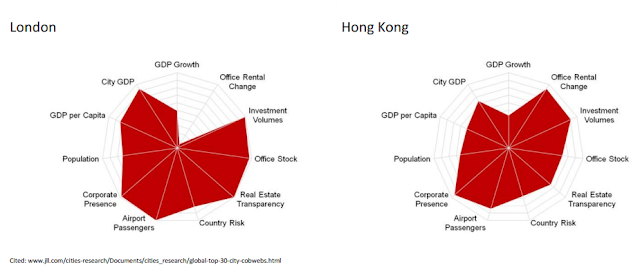

Investment Location

Our main investment objectives are focus on super cities such as New York, Los Angeles and expand to other markets such as Hong Kong and London in near future. Each of these markets is benefiting from the following positive trends:

- Consistent Growth Rate

- Stabilize Value

- High Demand

- Minimum downside risk

- Ease of capital events

Equitybase Platform Technology Stack

Equitybase platform is a standalone P2P network protocol design for digitizing real estate into a decentralize system. We are designing a robust DAPP for a desktop and mobile app which allows each user to interact with their holdings on the platform and also for sponsors and developers to list and update property status.

Equitybase platform software components using the following technologies:

Equitybase Revenue

Equitybase will obtain up to 2% of net profit proceeds from general income and 2%+ from capital events.Equitybase will charge a 1% fees for platform listings for real estate developer and sponsors interested in listing their prospective properties on our platform. Investors and sponsors can reduce or waive fees entirely by obtaining equivalent amount of BASE token value.

Rental Income

Cash flows from operations are to be distributed in the following order:

- Senior debt service payments

- Payment of current preferred return to the REO

- Remaining proceeds to all common deal-level equity holder

Capital Events

Proceeds from capital events are to be distributed in the following order:

- Outstanding loan balance payoff

- Payment to the REO of any unpaid current preferred return

- Payment to the REO of the accrued preferred return

- Return on invested capital to the REO

- Remaining proceeds to all common deal-level equity holder

Equitybase ICO

BASE: EquitybaseERC20 Token

Public ICO of BASE Token will begin on 02/28/2018 and end on 05/22/2018 with initial discount of 30%, discount rate will be lower in increments of 5% weekly over the duration of the ICO sale. Minimum contributions during the public ICO will be at 0.001 ETH. Transfer rate is set at $0.28/Per BASE Token.

Token Distribution

Total availablity of BASE token will be set at 360,000,000 of which 50% will be sold during ICO, remaining reserve token will be held for 1 year and peridically release to stimulated the platform’s growth if needed. 20% of the tokens will be allocated to the founding team members and its advisors with a 12 month vesting period. 10% of overall token allotment will be distributed for community program marketing prior and after the ICO process.

Proceeds From ICO

Team And Advisors

For More Information Please Visit:

Website: https://equitybase.co

White Paper: https://equitybase.co/equitybasewhitepaper1.pdf

Twitter: https://twitter.com/equitybaseco/

Facebook: https://www.facebook.com/equitybase/

Telegram: https://t.me/equitybase

Medium: https://medium.com/equitybase

published by: Kontolq_Abo {https://bitcointalk.org/index.php?action=profile;u=1572785}

My ETH: 0xb7742Bb562b6acf9FAfAFFf3368D37972F671959

Tidak ada komentar:

Posting Komentar